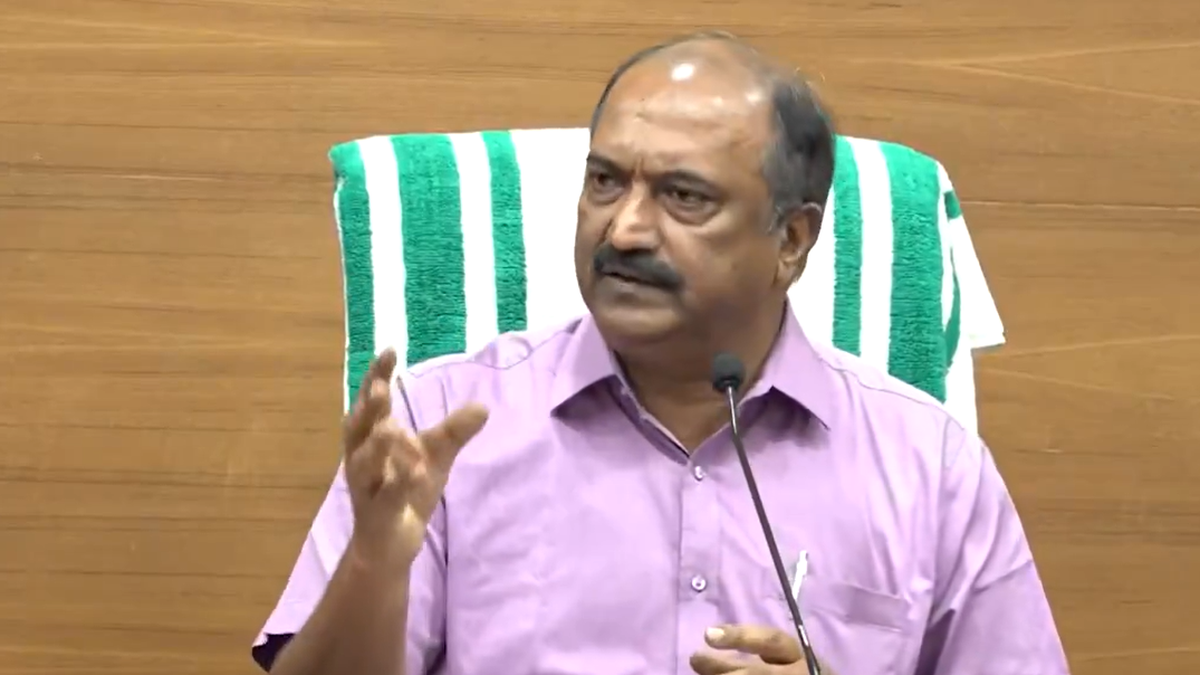

Kerala Finance Minister K.N. Balagopal on Sunday (September 14, 2025) said GST rate rationalisation benefits should be passed on to the common people, but if there is no compensation for the annual revenue loss, then states will be unable to continue to meet their social responsibilities.

For Kerala, the annual revenue loss due to the GST rate rationalisation is estimated at ₹8,000 crore to ₹10,000 crore.

Asserting that economic growth should be beneficial for the entire country, Mr. Balagopal told PTI that progressive taxation should not mean less tax for all and high-income or high-end luxury goods should be taxed more, which is the general good taxation practice.

The Goods and Services Tax (GST) Council, which represents the Centre and the states, approved a two-rate GST structure — 5 and 18% — on September 3. The revised rates, to be effective from September 22, will bring down the prices of a large number of items.

While Kerala has welcomed the rate rationalisation exercise, it is concerned about not having a compensation mechanism for the revenue loss.

Currently, there are four rate slabs — 5, 12, 18 and 28%.

In an interview with PTI in the national capital on Sunday (September 14, 2025), Mr. Balagopal stressed that if the GST rate rationalisation is not functioning with all the safeguards for the state, then the situation will be detrimental for the public finances in the future.

“GST rationalisation will result in huge discounts in taxes, and the prices should come down in the coming days. It should be passed on to the common consumers ‘Aam Aadmi’… in the past, whenever rate rationalisation came (in 2017-18), the tax difference was not passed on to the people,” the senior leader of the ruling CPI(M)-led Left Front in Kerala said.

Also read: Will the GST rate cuts boost the economy? | Explained

GST, sales tax and Value Added Tax (VAT) are among the main revenue income sources for a state, while the Centre has a lot more options, the minister said and highlighted that if the revenue loss is not compensated, then states cannot continue with their social responsibilities like health, education and public distribution system.

According to the Kerala-based Gulati Institute of Finance and Taxation, the state’s annual revenue loss due to the GST rate rationalisation is estimated to be in the range of ₹8,000 crore to ₹10,000 crore, with the revenue loss related to goods alone pegged at around ₹6,300 crore.

“The Indian economy is growing like anything. We are all happy about that… the growth should be beneficial for the entire country… those who are deserving should get it… Otherwise, a Laissez-faire economy and free market will not help the country to run,” Mr. Balagopal said.

If the states are weakened without anything for welfare activities, then “what is the meaning of development we are boasting about?” the minister asked.

On September 3, Mr. Balagopal told the GST Council that the current rationalisation framework considers revenue neutrality at the national level, but consumption patterns differ widely across states.

“For Kerala, where the consumption basket is heavily skewed towards higher-rate items, the impact will be disproportionately severe compared to the national average,” he had said.

As per the Kerala government, had the State’s GST revenue continued to grow even at around 12% from the protected revenue at the end of the compensation period, the revenue that would have accrued to the state would have been ₹51,892 crore in 2024-25, whereas the GST revenue was ₹32,773 crore in the same financial year.

Published – September 15, 2025 04:37 am IST